By

Ricardo Swire

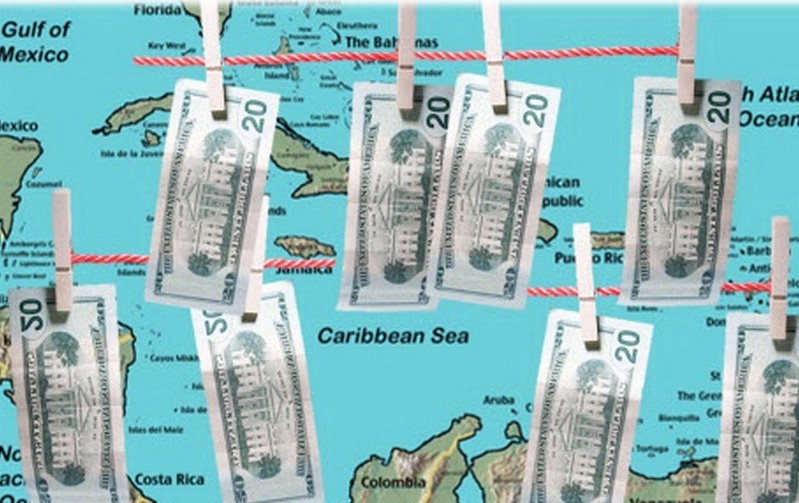

International documentation continues to highlight the seriousness of money laundering and drugs trafficking in Caribbean territories, a March 2017 US State Department Report focusing on the Federation of St Kitts & Nevis’ susceptibility to “corruption and money laundering.”

The Twin Island state’s internal security compromises and national safety breaches, caused by inadequate Citizenship by Investment Program (CIP)/Economic Citizenship vetting, referred to as “problematic.” The latest document attributed St Kitts & Nevis’ ongoing security deficiencies to “high volume drugs trafficking.”

Basseterre’s CIP vulnerabilities revolve around the Islands’ sub-standard passport antecedent procedures, in addition to no follow-up vetting after selectees receive St Kitts & Nevis’ special diplomatic passports. According to US State Department data four years have elapsed since the Twin Islands’ officials reported, prosecuted, or convicted any money launderers. The Western Hemispheric region had twenty-one Caribbean countries cited in both 2016’s International Control Strategy on Money Laundering & Financial Crimes and 2017’s US State Department’s Major Money Laundering Countries lists. St Kitts & Nevis featured at number seventeen.

Basseterre’s “growth of its offshore sector,” coupled with “unusually strong bank secrecy laws,” were labeled “problematic.” Antigua & Barbuda, Aruba, the Bahamas, Barbados, Belize, British Virgin Islands (BVI), Cayman Islands (CI), Cuba, Curacao, Dominica, Dominican Republic (DR), Grenada, Republic of Guyana, Haiti, Jamaica, Sint Maarten, St Lucia, St Vincent & the Grenadines (SVG), Suriname and the Republic of Trinidad & Tobago (T&T) are the others.

The American data informed that on Leeward Islands’ territory Antigua & Barbuda money laundering is facilitated through real estate, vehicle, boats and jewelry procurement. St Johns’ CIP is regarded as “among the most lax in the world.” Twenty-nine kilometers north of Venezuela’s coast Aruba is monitored as a South American transshipment hub, for drug consignments bound for America and Europe. The Island is well known for illegal bulk cash smuggling along reverse courses. Money laundering is achieved via domestic land purchases and international tax shelter provisions.

The Bahamas facilitates money laundering promoted by gaming, drugs, firearms and human trafficking. Transnational Drug Trafficking Organizations (DTOs) monopolize the Bahamas’ International Business Centers (IBCs) and registered offshore financial institutions, known for contraventions of transaction reporting requirements, to sanitize dirty cash. Transnational DTOs use Barbados especially for money laundering and firearms trafficking operations. The island’s international financial institutions join real estate, vehicle, boat and jewelry purchases to launder illicit cash.

The former British colony Belize is categorized as “vulnerable to money laundering,” due to lack of impactful law enforcement offensives and “strong bank secrecy protections.” Belize’s location, on the eastern coast of Central America, is taken advantage of mostly for trafficking. The capital Belmopan characterized as a haven for “tax evasion, securities fraud and conventional structuring schemes.” On the British Virgin Islands money laundering is primarily connected to abuse of corporate vehicles. The Cayman Islands popular among DTOs and criminal organizations that specialize in “fraud, tax evasion and cocaine trafficking.”

Cuba’s mention in the Report referred to the island’s vital geographic location, between drug producer and consumer nations. Placed in the southern Caribbean Sea Curacao is popular among DTOs for “availability of US currency, offshore banking and incorporation systems.” Wire transfers, international tax centers and cash movement between Willemstad, the Netherlands and other Dutch Caribbean members are evident. The US State Department file also pinpointed domestic money laundering connected to drugs trafficking.

The Commonwealth of Dominica’s CIP is described as “vulnerable,” with susceptibility to abuse by criminal actors. Roseau’s advance fee fraud schemes and placement of Euros, derived from questionable corporate activities, prevalent weaknesses. The Dominican Republic is named due to identified government and private sector corruption. Transnational DTOs, a large underground economy and weak national financial controls, expose the capital Santo Domingo to money laundering undertakings. Forged credit cards is the most popular fraud.

Grenada and its six smaller islands, at the Grenadines’ southern end, have vulnerabilities listed as money laundering perpetrated by domestic organized crime syndicates. Illegal cash is cleaned thru a variety of legitimate businesses, real estate, boat, vehicles and jewelry purchases. The US State Department’s report noted that Guyana’s primary source of money laundering is via corruption and drugs smuggling. Human trafficking, contraband, illegal natural resources extraction and tax evasion viewed as “substantial.”

Money laundering manifests as fictitious sale agreements for non-existent precious minerals which accompany big cash deposits in domestic financial institutions. Small cross-border precious metals transfers, officially declared as scrap or broken jewelry to avoid taxation, identified fraudulent schemes. Mature cash couriers are recruited for cross-border travel, carrying large amounts of American cash. Haiti’s money laundering ploys revolve around US cash deposited offshore or in domestic non-financial institutions, such as restaurants, barber shops and other small businesses.

Property seizures involved major drug traffickers convicted in American courts. Substantial illegal funds are generated from “corruption, tax fraud, government monies embezzlement, smuggling, counterfeiting, kidnapping for ransom, illegal migration and associated activities.” Jamaica is listed in the report based on money laundering proceeds generated by local organized criminal gangs’ drug trafficking, financial scams and extortion activities. Commercial offences are related to “cyber-crime and advance fee fraud or lottery scams that mainly target American citizens.” On Sint Maarten criminal profits are amassed through use of corporate investments and international tax centers.

The recent US report considered the Philipsburg based government to be “weak.” St Lucia’s money laundering is united with drugs trafficking revenue. Financial institutions on the island unsuspectingly facilitate currency transactions, comprised of international drug smuggling proceeds. St Vincent & the Grenadines remains vulnerable to money laundering and financial crimes proceeds, from drugs trafficking and Kingstown’s offshore financial sector. SVG has a small but very active financial center, with a substantial amount of International Business Centers (IBCs). Couriers, go-fast boats and pleasure yachts smuggle American currency to SVG.

The March 2017 Report intimated civic corruption and transnational criminal activity drives Suriname’s money laundering continuation. Profits made mostly from cocaine trans-shipments en route to Africa and Europe is invested in casinos, property, foreign exchange companies, car dealerships and the construction industry. Trinidad & Tobago’s underworld earnings originate from drugs trafficking, illegal gun sales, fraud, tax evasion and corruption. DTOs and organized crime entities, functioning both domestically and worldwide, manage the majority of dirty money transiting T&T.

No Comments Yet!

You can be first to comment this post!