By

Niyi Aderibigbe

Mobile phones have proven to be potential game-changers in boosting access to financial products and services to people in Africa. This is particularly true for those at the bottom of the socio-economic pyramid as seen in East Africa.

It has often been appraised based on its contribution to ‘banking the unbanked’, but mobile money has achieved much more: it has saved the continent nearly $2 billion previously lost annually to inefficient money transfers.

UK-based think thank, Overseas Development Institute (ODI), in a 2014 report noted that Africans in diaspora pay an average of 12 percent to money transmitters to send $200 home. This is a far cry from the global average of 7.8 percent and more than double the 5 percent target set by the G8. “These excess fees cost the African continent $1.8 billion a year; enough money to pay for the primary school education of 14 million children in the region.”

Why Africa pays so much

Weak competition, concentration of market power and flawed financial regulations all contribute to high remittance charges, according to ODI.

Western Union and MoneyGram are the two leading money transfer operators (MTOs) that account for two-thirds of remittance transfers, and ODI estimates that both will account for $586 million of the loss associated with the remittance ‘super tax’, part of it through opaque foreign currency charges. ‘Exclusivity agreements’ between MTOs, their agents and banks also restrict competition and make prices jump.

However, WorldRemit, a UK-based company founded by a Somalian, is providing much-needed competition.

“With fair and transparent prices, we are challenging the “Remittance Super Racket” of incumbent money transfer companies in Africa which continue their practices of agent-exclusivity arrangements and charging unreasonable fees. We are embracing mobile money as new technology that is set to revolutionise banking from the ground up and make money transfers more convenient for everyone,” CEO & Founder of WorldRemit, Ismail Ahmed said in an interview.

Ahmed, who founded the online money transfer service in 2010 aims to use technology to shake-up the industry, which he considers stagnant. “By taking the industry online and refusing to engage in anti-competitive practices, we are bringing fairer, lower cost remittances to Africa.”

Years of experience working with a number of remittance businesses, as well as international policy makers has taught him that mobile money is a technology that addresses an important human need; access to financial services. With this at the back of his mind, he partnered with EcoCash and MTN to enable instant transfers to the telcos’ mobile wallets. The company is also close to launching instant mobile money transfers to EcoNet in Burundi. More than 50 percent of WorldRemit’s transfers to Africa are currently received as Mobile Money or airtime top-ups.

Why is remittance important to Africa?

Money sent home by friends and relatives working abroad is critical to the survival of many in rural communities within Africa. Without a decent job or money-making trade, many rural dwellers depend on handouts to cater for domestic bills.

This has made the innovative transfer service popular within Africa. The continent received $32 billion in 2013 and is expected to receive more than $40 billion by 2016.

Somalia is heavily dependent on remittances. Money sent home by Somali Americans to Mogadishu is estimated to hit $215 million annually. This accounts for about 4 percent of the country’s GDP.

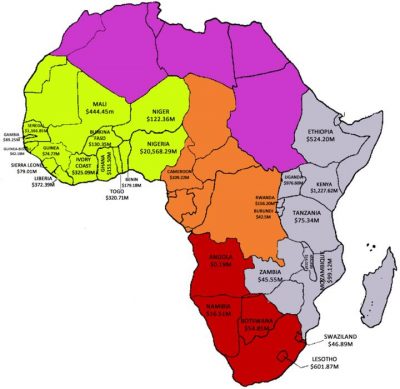

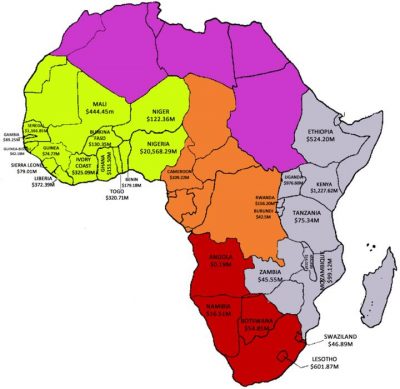

Remittance flows to Sub-Saharan Africa

According to Jonathan Scanlon of Oxfam America, remittances to Somalia is the largest and most important financial flow going into the country. “It really is a lifeline for the country.”

Nigeria, Africa’s largest economy also depends on remittances for foreign exchange. Money transfers, mainly from North America and Europe, make up the country’s second highest foreign exchange earner. The country is also Africa’s top remittance recipient, accounting for around two-thirds of total remittance inflows to Sub-Saharan Africa. Remittance to Nigeria is recorded at $21 billion for 2014 alone.

While making a case for donor agencies to restructure the way aids are channelled for more efficiency, Hong Kong based Ghanaian academic Adams Bodomo claimed that Africans living outside the continent send more money home than what traditional Western donors send as Official Development Assistance (ODA).

Africans in the diaspora have recognised the importance of the money they send home to their families. With mobile money proving to be a more effective means of transferring funds home, they are increasingly adopting the service.

A GSMA report for 2014 highlights that “2014 saw a steep increase in the number of international remittances via mobile money, primarily driven by the introduction of a new model using mobile money as both the sending and receiving channel.”

Banking the unbanked

Mobile money continues to expand the reach of financial services in highly unbanked Africa. According to Frans Prinsloo, Managing Director at Hollard International, South Africa’s largest privately-owned insurance group, “The rapid uptake of mobile telephony, the introduction of smart phones and cloud computing, and the availability of affordable data have forever changed the financial services landscape.”

Today, the number of active Mobile Money accounts globally now exceeds 100 million and sub-Saharan Africa accounts for more than half (53 percent).

“Cash is increasingly becoming an obsolete technology as the developing world sprints ahead of the developed in its adoption of Mobile Money,” Ahmed of WorldRemit further explains.

Bill Gates recently made a big bet that by 2030, almost everyone will have a mobile money account. “Not having access to a range of cheap and easy financial services makes it much more difficult to be poor.

“Traditional banks cannot afford to serve the poor because of their costs. That’s why 2.5 billion adults don’t currently have a bank account,” Gates stressed.

Mobile money is affording the poor access to more financial services everyday. From savings account to credit insurance, the technology is saving Africa, a continent where nearly 50 percent of its population are resident in rural communities.

However, there is still a long way to go to finally establish a robust cross-border transaction market using mobile technology. Although its potential to lower costs is undisputed, its use remains limited due to the regulatory burden related to combating money laundering and terrorist financing.

This article has been reproduced with the kind permission of Niyi Aderibigbe and was originally published by Ventures-Africa

Niyi Aderibigbe

A writer with over seven years experience working on different sectors in Africa, aim to use my experience writing and editing for business, science and new media, to effectively foster personal and organisational growth. I possess an M.Sc in Environmental Biology and intend to research more on the unique connection between business, politics and the environment, to further drive prosperity in Africa.

No Comments Yet!

You can be first to comment this post!